We are in financial forecast season, and it is easy to get enamoured by highly credentialed economists or flashy fund managers as they release their latest round of predictions.

Ideas about the future are abundant, but there is a lack of consensus! Authors of forecasts see the same data yet have wildly different views on how the market will play out…with or without tariffs.

Part of the reason why this game has gone on so long is that it is a challenge to keep financial forecasters accountable. By the time the data is in for the previous year, they are about to release their next round of educated guesses. Not many who missed the mark will humbly admit to where their ideas parted from reality. They are freshly excited to share their latest view on the upcoming success or demise of the world.

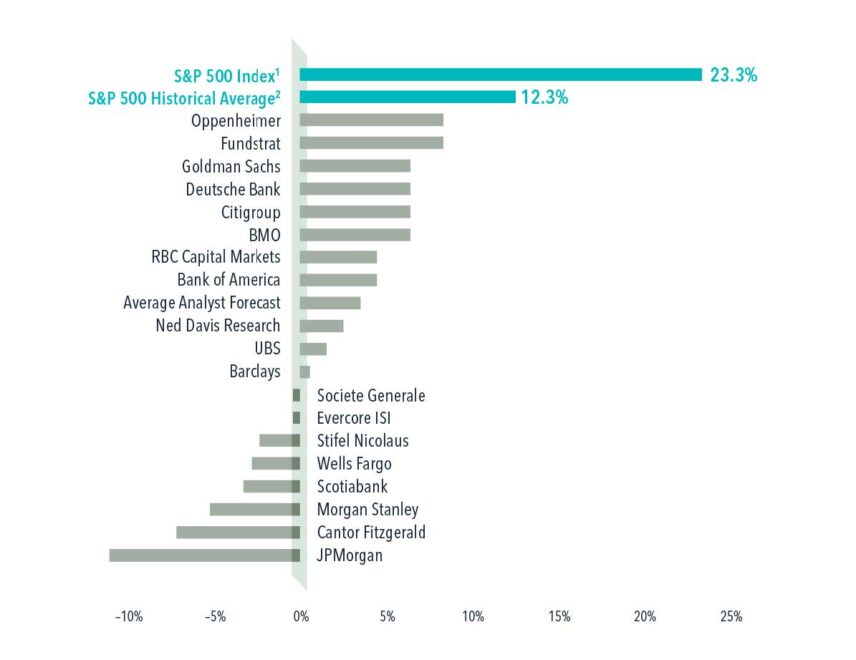

If we look back to S&P500 predictions for 2024, we can see just how far spread the estimates were and how no one anticipated the successful year we had in the markets.

The expectation according to the average was a positive year of just under 5%…significantly off the actual return of 23.3% (USD).

Not only that, major financial institutions (JPMorgan, Morgan Stanley, Scotiabank), with all their access to top talent and information, were well off the mark! JP Morgan’s prediction was 30% in the wrong direction!! Imagine listening to these reports in early 2024 and making investment decisions accordingly.

Investing is a dangerous game due to this inconsistent and salesy information. It takes a clear mind and a process-driven investment approach to stay in the center of the road and not the ditch.