In a world of information, data is at a surplus, but answers are fleeting. We are in a crisis of truth where numerous sources with opposing opinions report to hold the key.

How do we navigate this age of (dis)information, confusion, and strong opinions?

The health industry continues to be a great parallel to the investing industry. There are some interesting ideas out there when it comes to diet and what promotes best overall health. The spectrum goes all the way from a diet containing only meat, to one containing only vegetables/fruit/legumes.

One can find compelling information supporting the benefits of either option or every other option in between. When I cannot find a more black and white solution solidified with facts and hard proof, I start looking for patterns. What series of actions improve my odds of the desired outcome?

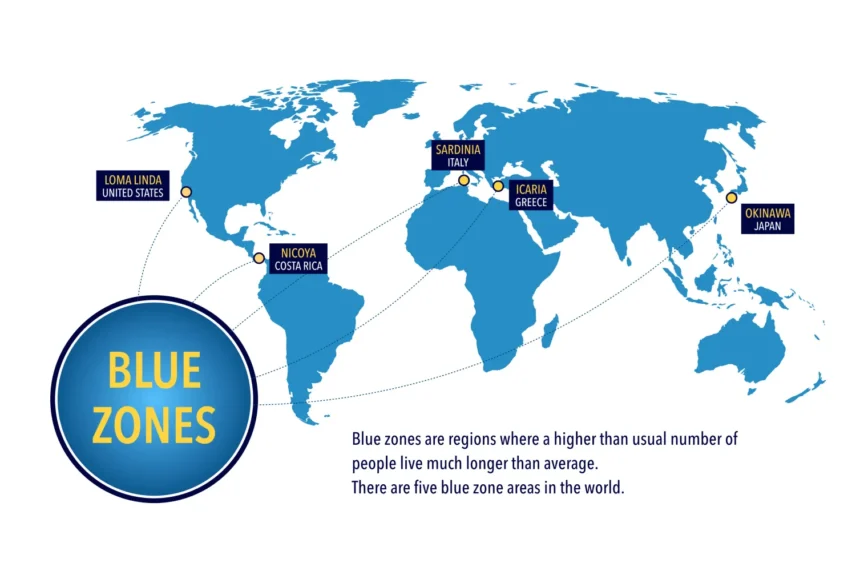

With diet, why not look at the populations who not only live the longest, but who also hold onto their health the longest. No point living to 100 if you are bed-bound for twenty years! The Blue Zone book and documentary summarizes information uncovered in regions of the world that have the highest percentage of centenarians. The resulting information is more from observations rather than carefully curated studies of measurements and exactitudes. Patterns more than facts.

In the infamous words of Tom Cruise playing Jerry Maguire…“Show me the Money!!” and what better way to see the money, than to look into the eyes of the people who have done it generation after generation. The Blue Zones around the world have many similarities when it comes to diet. Vegetables/fruit/legumes are the predominant source of nutrients with meat only on the plate for special occasions and sparingly, if at all.

The world of investing has a similar conundrum. You have options ranging from hyper-active hedge funds, with complex alternative strategies, all the way to index matching portfolios with no company buy/sell decisions. Again, information supporting either option or everything in-between is available.

The Blue Zone study of investing is the SPIVA report. This report compares actively managed (conventional) investment solutions to the underlying benchmark (index). It shows that a small percentage of conventional solutions can beat their index but it happens rarely!

Indexes do a great job of building wealth…comparatively better than conventional solutions. The pattern is well established.

At Relay Wealth Advisors, we use this pattern to our clients’ benefit. The past is not indicative of future results, but the past can present patterns that we can use to increase our odds of desired outcomes.

In the end, that is all any of us can do…leverage the patterns of the past and aim to improve for the future.